Upon first glance, accounting might seem like a fairly straightforward profession—it’s just crunching numbers, right? While it’s true that working with financial data is a substantial part of the job, accounting is a critical business function that involves much more problem solving than you may think. For instance, leveraging assets, managing budgets, achieving financial efficiencies, and maximizing investments are just some operations of accounting and finance management that go beyond what most people consider the profession to be.

So, what does an accountant actually do on a daily basis? Here, we’ll discuss the daily tasks, roles and responsibilities, important skills, and career outlook for accountants, as well as the trends impacting the field.

What is an Accountant?

An accountant is a professional who is responsible for keeping and interpreting financial records. Most accountants are responsible for a wide range of finance-related tasks, either for individual clients or for larger businesses and organizations employing them.

Several other terms are often discussed in conjunction with the phrase “accountant,” which can lead to confusion on what this career actually entails. For example, “accountant” and “bookkeeper” are phrases that are sometimes used interchangeably, yet there are several key differences between these job titles.

Typically, bookkeepers will have earned at least an associate degree and focus on recording financial transactions. Accountants, on the other hand, will have typically earned at least a bachelor’s degree in accounting, and are tasked with interpreting financial information rather than simply gathering it.

In short, accountants can be bookkeepers but not all bookkeepers are accountants.

Additionally, a certified public accountant (CPA) is an accountant who has passed the CPA exam and has met state licensing requirements. So, all CPAs are accountants, but not all accountants are CPAs.

Accounting is a broad term that encompasses multiple different job titles and roles within organizations. There are three main types of accountants—public accountants, management accountants, and government accountants—all of which focus on different aspects of the profession. Internal and external auditors are also closely related.

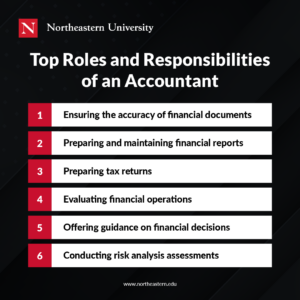

Roles and Responsibilities

Although the daily duties of an accountant will vary by position and organization, some of the most common accounting tasks and responsibilities include:

Additionally, accountants have a legal obligation to act honestly and avoid negligence in their practices. As such, they are also responsible for ensuring that their clients’ financial records are compliant with the relevant laws and regulations.

What Skills Do Accountants Need?

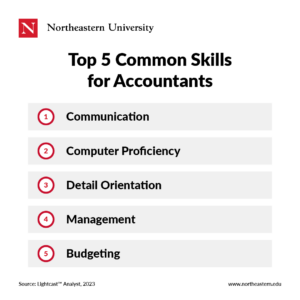

There are several soft and technical skills that all accountants need in order to be successful in their roles. Some of the most important skills for accountants are:

Soft Skills

Common skills are incredibly important when considering your long-term success in accounting. According to data pulled from active job postings, here are the top common skills employers are looking for in accounting professionals.

1. Communication

Accountants must be able to listen carefully in order to accurately gather facts and figures from clients, managers, or other stakeholders. They must also be able to clearly articulate the results of their work and present their findings in written reports.

2. Computer proficiency

Professionals in this field need to be able to use advanced accounting software and other computer-based tools to work effectively.

3. Detail orientation

Accounting professionals must pay strong attention to detail in order to keep information accurate and organized. With the amount of financial data that must be analyzed, it can be easy to make mistakes; however, simple errors can translate into much larger problems if they’re not caught.

4. Management

To be effective in this role, an accountant must understand the basic functions of a management to provide accurate direction and guidance to coworkers and clients seeking financial advice.

5. Budgeting

A common misconception is that you have to be good at math to be an accountant. While math skills are important, complex mathematical skills aren’t typically necessary to tackle the budgeting functions of an accountant.

Specialized Skills

While common skills are important to an accountant’s professional success, specialized skills ensure they are highly effective in the field. According to data pulled from active job postings, here are the top specialized skills employers are looking for in accounting professionals.

1. Accounting principles

Accounting principles are critical for ensuring accountants don’t give clients bad guidance or mislead them with poorly maintained financial statements. Without these principles, an accountant won’t last long in the field.

2. Finance

Since accountants give clients financial advice, it is important that they understand finance, know the terminology, and feel comfortable navigating conversations around finances.

3. Auditing

While not every accounting professional requires auditing skills, it can be a useful skill since it ensures financial data is accurately depicted in accordance with modern accounting standards.

4. Financial statement literacy

Since accountants create, maintain, and reference financial documents on a daily basis, they need to understand all aspects of the most common financial statements.

5. Financial analysis

Collecting and analyzing financial data is a large part of accounting and is an important aspect of identifying patterns and potential issues. In fact, applying data analytics to the accounting field is an emerging trend in the industry that is expected to have a growing impact in the future.

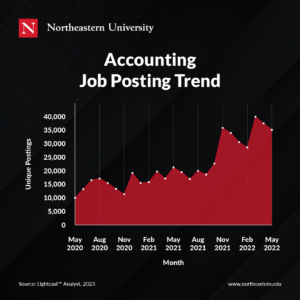

Are Accounting Jobs in Demand?

Accounting is an in-demand career with impressive salaries and job growth to match.

Data from the Bureau of Labor Statistics (BLS) projects that the employment of accountants and auditors will grow 6 percent by 2031. Our analysis of industry trend findings also found that unique accounting job postings have experienced substantial growth. From May 2020 to May 2022, the number of unique accounting-related job postings per month increased by nearly 20,000.

Our reports also show how compensation plays a key role in the growing popularity of this industry. According to our job posting analysis, while the average median salary for accountants with a bachelor’s degree is $64,900 per year, gaining additional experience in the field will pay off in the long-run. For example, accountants with one to three years of experience can earn between $57,000 to $70,000 per year. Those with five to seven years of experience can expect an average median salary of $73,100. Finally, accounting professionals with ten plus years experience can earn up to $121,200 per year.

Location also plays an important role in determining an accountant’s earning potential. Factors such as cost of living and scarcity of talent influence the salary you can expect to earn in a given city or region. For example, data from Robert Half shows that individuals in all industries and professions who live in areas like Boston, New York City, and San Francisco earn an average of 34 percent, 40.5 percent, and 41 percent more than the national average, respectively.

Most employers require that candidates hold at least a bachelor’s in accounting or another related field, such as Finance and Accounting Management. Additional certifications are also preferred in many cases; holding these credentials can help improve a job seeker’s prospects. As such, many professionals in the accounting field choose to become Certified Public Accountants, or CPAs, by completing the licensing process administered by the Association of International Certified Professional Accountants.

However, there are other career options worth considering beyond a Certified Public Accountant. The industry is filled with a wide range of in-demand finance and accounting careers. So whatever type of accounting path you choose, there’s incredible job growth opportunities for accountants.

Top Accounting Trends To Consider

To succeed in this field, aspiring and current accounting professionals should stay up-to-date on these developments to keep their skills relevant and maintain a competitive advantage in the workplace.

1. Accounting Automation

Automated accounting software, such as QuickBooks and other popular applications, are becoming increasingly influential in the industry. In fact, a recent survey found that bookkeepers and accountants spend roughly 86 percent of their time on tasks that have the potential to be automated.

This doesn’t mean that accountants will be replaced by machines, though. Rather, the increased use of automation means that accountants will spend less time on manual tasks like data entry and more time on meaningful analysis.

Implementing accounting automation can allow accountants to streamline their workflows and become more effective. With these emerging technologies, labor-intensive tasks like tax preparation, payroll, and audits can be automated to reduce the amount of time and resources needed to move forward.

2. Transparency and Security

Among the most important trends in the accounting field are the increasingly high standards surrounding transparency in accounting and a greater focus on data security.

In the wake of accounting scandals and increased scrutiny following the 2008 financial crisis, it has been important to restore trust and credibility to the profession. As such, an industry-wide push for transparent reporting has influenced the financial reporting process.

This effort has expanded upon the public’s expectations of accurate reporting to go beyond basic honesty. As a result, companies are now expected to report their financial statements to the public in order to paint a complete picture of their current standing and reduce uncertainty in the market.

Furthermore, since accountants are responsible for sensitive data, it is increasingly important to maintain strong security practices to ensure the safety of the organization or client’s private information. Several infamous data breaches over recent years have illustrated the need for advanced protection practices, and accountants will need to stay up-to-date with current security measures in order to protect sensitive information.

3. Data Analysis

Today, accountants and CPAs are performing tasks that require analytical skills at increasing rates, largely due to the proliferation of data across industries.

There are many applications of data analytics in the world of accounting. For example, auditors are using analytics to enable processes like continuous monitoring and auditing. Similarly, accountants who take an advisory role within their organizations can use big data to identify patterns in the behavior of consumers and markets, which can lead to investment opportunities and higher profits.

Modern accountants should develop an analytical mindset in order to keep up with trends in the industry and remain competitive in the workforce.

How To Become an Accountant

It’s clear that accounting involves more than just crunching numbers—it’s an in-demand field with countless opportunities to offer. Due to the exponential growth of the accounting and finance industry, the benefits of getting an accounting degree are more evident than ever before.

If becoming an accountant is the next step in your career, there are many resources available, such as accounting programs to help you prepare for this role. One important step is to ensure you are pursuing the best education possible with a Bachelor of Science in Finance and Accounting Management, which can help you meet the expectations of potential employers and reach your professional goals.

To learn more about this, and other bachelor’s degree programs that can propel your accounting career, explore our program pages.