Accounting has long been a popular career choice for a simple reason. Businesses have always needed, and will always need, individuals with accounting skills. Regardless of the industry, companies large and small across virtually all sectors of the economy employ accounting professionals. This demand has translated into high levels of job security and competitive salaries.

If you’re looking to launch your finance and accounting career, you may be wondering if an associate degree in accounting is enough to get you started. Below, we explore some of the job titles Lightcast identifies as ones you can likely pursue after you’ve earned your associate degree, as well as ways you can advance in your career.

Jobs with an Associate Degree in Accounting

1. Bookkeeper

Median Annual Salary: $44,200

Bookkeepers often perform a wide variety of tasks. They may oversee multiple accounts and conduct more financial analysis by recording income and expense transactions, processing payments, performing banking activities, producing financial reports, and reconciling reports to records. For these reasons, bookkeepers need exceptional time management and organizational skills.

2. Payroll Clerk

Median Annual Salary: $41,600

As the title implies, payroll clerks maintain a company’s payroll. They collect, calculate, and enter data into payroll records regularly and update records when payroll changes occur, such as deductions, promotions, and exemptions. Then, clerks compile summaries and write reports on earnings, taxes, deductions, and other compensation payments. Clerks are also expected to resolve any payroll discrepancies and oversee payroll policies and procedures. Because payroll clerks may need to interact with employees or vendors who have questions, solid communication skills are critical. These professionals should also be comfortable entering and analyzing data, have strong attention to detail, and be highly organized.

3. Accounting Assistant

Median Annual Salary: $40,600

Accounting assistants typically work in private accountant offices or within a large organization and support the department with entry-level and office-based accounting duties. These duties may include tasks such as working on accounts receivable and accounts payable, collections, billing, audits, journal entries, fact-checking data, and recording transactions. As an accounting assistant, you should be reliable, detail-oriented, comfortable working independently, and have basic computer skills.

4. Accounting Clerk

Median Annual Salary: $39,600

Accounting clerks are typically entry-level and are critical to businesses. Their core job is to keep records and accounts reconciled and accurate. They prepare and maintain accounting documents and records, bank deposits, statements, and general ledger postings regularly. Accounting clerks also provide summaries and reports to upper management to help them focus on complex financial strategies. Typical skill requirements for this role besides an associate degree include accounting experience, familiarity with bookkeeping and accounting practices, computer software experience, an eye for detail and accuracy, and the ability to file and keep records.

5. Administrative Assistant

Median Annual Salary: $38,500

Administrative assistants provide clerical assistance to a range of departments within a business, including the accounting team. They perform general office duties such as answering the phones and greeting customers but are also tasked with accounting-based tasks, like processing invoices, updating budgets, processing transactions, or preparing bank deposits. For this role, you’ll need computer software skills, basic mathematical and financial principle skills, and to be savvy with office equipment.

6. Auditing Clerk

Median Annual Salary: $38,300

An auditing clerk’s primary responsibility is ensuring all financial records—expense accounts, loans, commissions, bank records, inventory, accounts payable, etc.—are accurate and appropriately coded. Inaccuracies can range from data input errors or incorrect spreadsheet formulas to more severe situations that would require an accountant to resolve. This role requires that individuals compute numbers, scrutinize data, properly prepare documents, and write reports.

Is an Associate Degree in Accounting Worth It?

Based on these job titles, it is clear that pursuing a career in accounting is worth it for many students. There are a wide range of opportunities for individuals in the accounting profession that are projected to increase. According to our industry trend findings, unique accounting job postings that require an associate degree have experienced substantial growth. From May 2020 to May 2022, the number of unique accounting-related job postings per month increased by nearly 20,000.

The U.S. Bureau of Labor Statistics echoes this trend, projecting that the demand for accounting positions will grow 6 percent from 2021 to 2031, which is about as fast as the average for other professions.

To benefit from this demand and advance your career, you need to be aware of the requirements you should meet to raise your salary potential even further.

Advancing Your Accounting Career

As seen above, earning your associate degree in accounting opens up several entry-level positions that could help launch your career. You may have noticed, however, that some of the more common and higher-paying accounting and finance jobs are missing from the list above. That’s because, to qualify for many of the most in-demand accounting jobs, you’ll need to earn your bachelor’s degree.

“If you feel like having an associate degree in accounting has not been adequate to your career goals and ambitions, then a bachelor’s degree is definitely the next step for you,” says Dustin Snider, lecturer at Northeastern University’s College of Professional Studies.

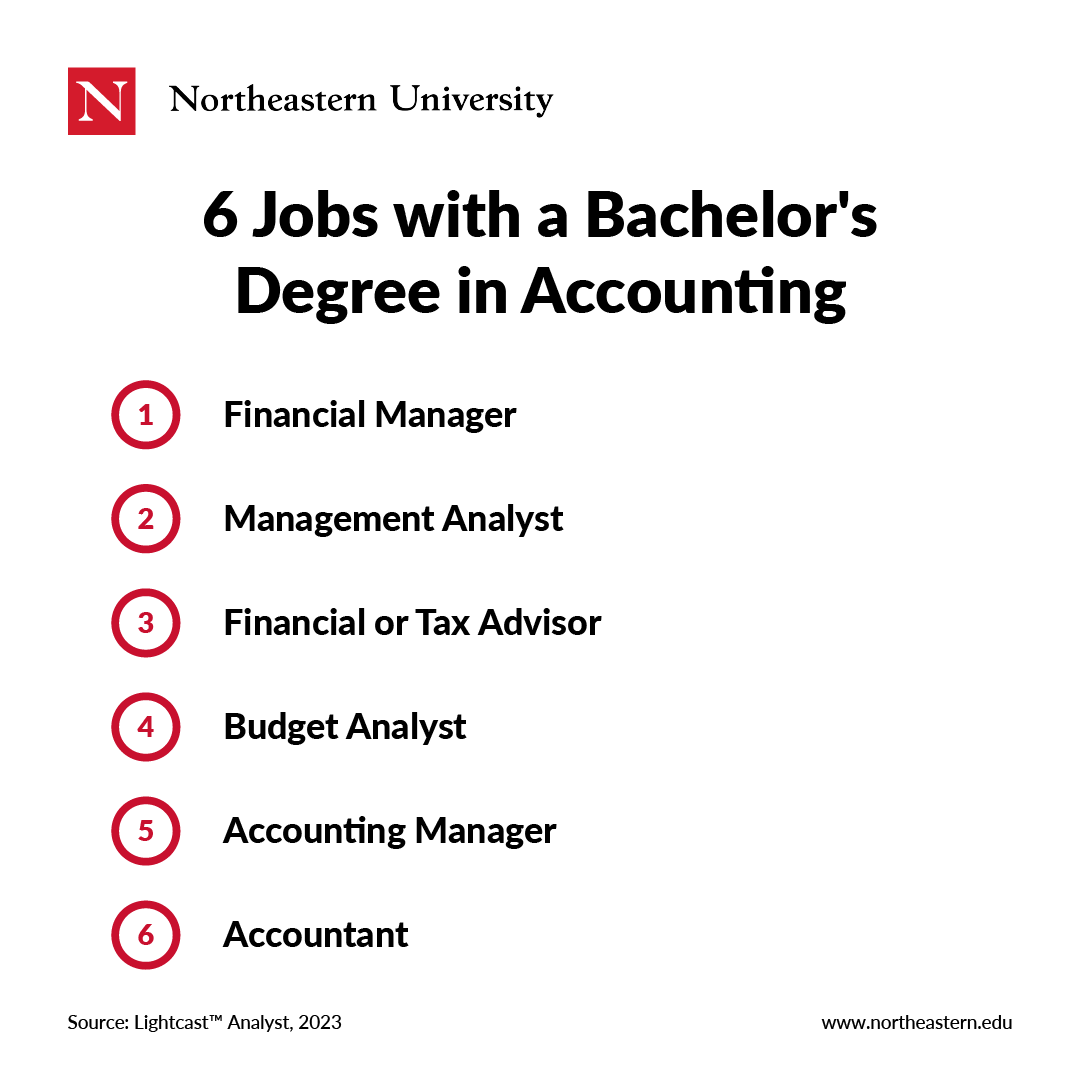

According to our industry data, earning your bachelor’s degree can open you up to a range of new career opportunities, including:

- Financial Manager

- Management Analyst

- Financial or Tax Advisor

- Budget Analyst

- Accounting Manager

- Accountant

While this isn’t a comprehensive list, it does include common job titles within the industry. Note that some of these roles may require additional education and certification. For example, you may want to earn your Certified Public Accountant (CPA) license and potentially a master’s degree in accounting to qualify for even more advanced roles.

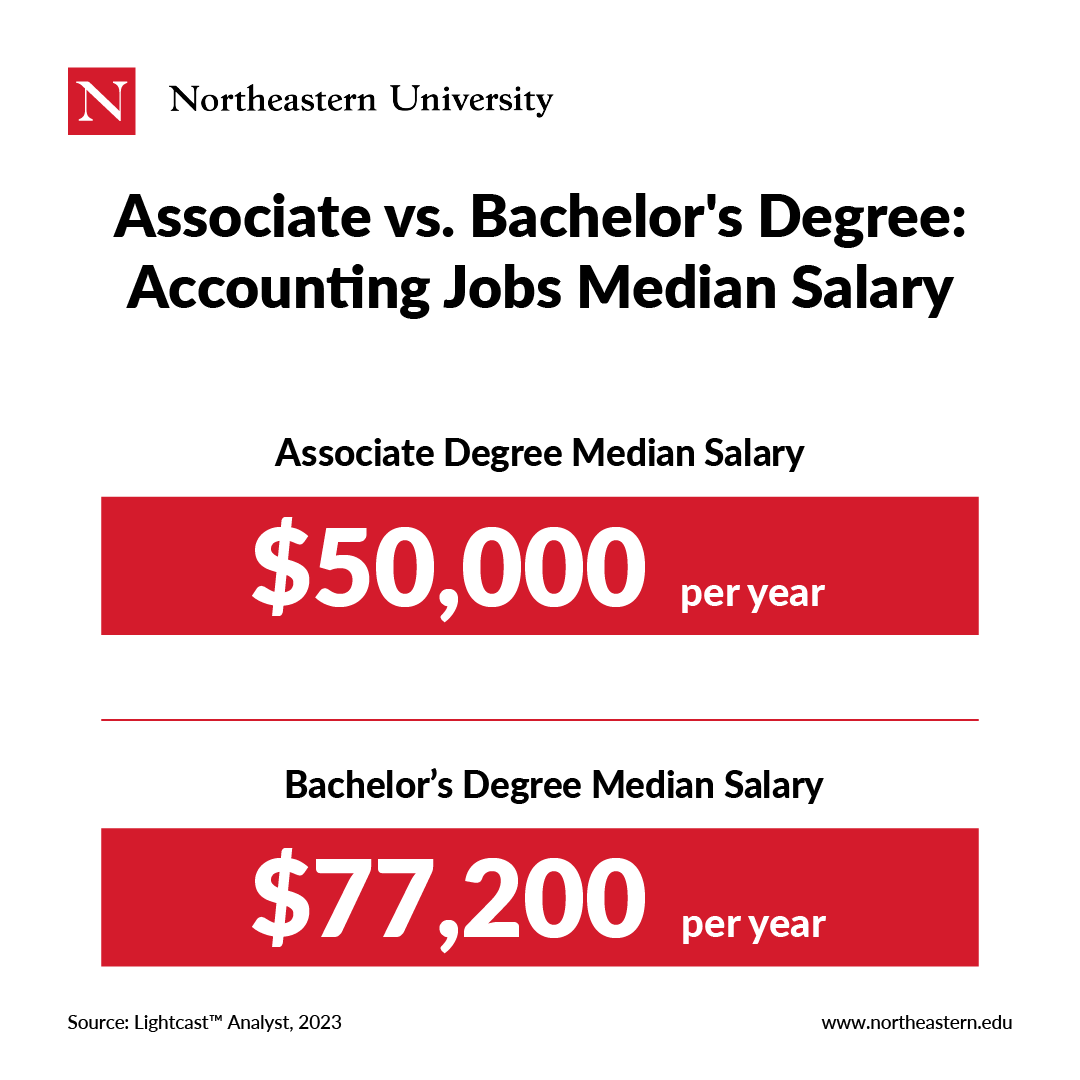

However, taking on this extra work often boosts your overall earning potential. For example, the median annual salary of an accounting professional with an associate degree is $50,000. On the other hand, those with a bachelor’s degree earn a median annual salary of $77,200 according to our industry data.

If you have already earned your associate degree in accounting or are close to completing your degree, enrolling in a bachelor’s completion program like the one offered by Northeastern University can be an excellent way of taking your career to the next level. Such a program will allow you to leverage the credits that you’ve already earned so that you can graduate in a quick, cost-effective manner. Similarly, if you’ve completed your associate degree and spent some time working in one of the careers mentioned above, the bachelor’s completion program can be an excellent fit for you.

“The Finance and Accounting Management program is a great way for someone who has real-life work experience to earn their degree with a flexible schedule,” Snider says. “The classes here are built very specifically to try and get you back into the working world as quickly as possible.”

After you’ve earned your bachelor’s degree, some ambitious individuals choose to pursue an advanced degree to excel even further in their careers. In that case, you may also consider earning a Master of Science in Accounting or Master of Science in Accounting and Business Administration.

To learn more about earning your finance and accounting management degree, explore our program page or request more information.